Corporate Medi Solutions is a comprehensive Medicare insurance brokers/agency that specializes in assisting Medicare eligible individuals in understanding and obtaining the appropriate coverage available through Medicare.

Medicare can be a complex federal program, and our team of experts with over 30 years of combined experience is here to guide you through the process. We work closely with medical groups to provide advice on the various insurance carriers in the market and their effectiveness. Our services include managing the relationship with the Medicare insurance carrier and even CMS in certain cases. By partnering with us, medical groups can enhance retention by offering dedicated Medicare consultants to their patients at no cost. Corporate MediSolutions is the solution to the increasing number of Medicare eligible individuals in the region. Let us help you align your patients’ Medicare insurance with the services offered by your medical group.

INSIDE

- Retirement will be different in 2024

- Memorial Day

- Benefits of having a Medicare

- Consultant

- Juneteenth

For more articles and events visit our website: www.c-medisolutions.com

Retirement Will Be Different in 2024

How changes in Social Security, Medicare, taxes and more will affect your finances.

There are various ways that changes in key areas of retiree life such as Social Security benefits, Medicare premiums, tax and savings poli-cies geared for older adults can impact your finances as they interact with economic shifts caused by higher inflation or a market downturn. Social Security Benefits. This year social security recipient monthly pay-ments increased by 3.2 percent because of the cost-of-living adjustment (COLA).

Medicare costs

After coming down by 3 percent in 2023, standard premiums for Medicare Part B are going back up in 2024, from $164.90 to $174.70 per month, a 6 percent increase.

Retirement plan contributions

If you are 50 or older, you can put up to $8,000 into an individual retirement account (IRA) for the 2024 tax year. That includes the $1,000 catch-up contri-bution available to older savers. The cap for people under 50 is $7,000. In both cases, the contribution limit has been bumped up by $500 from 2023. (By the way, you can still make your contributions for the 2023 tax year — the deadline is April 15, 2024.)

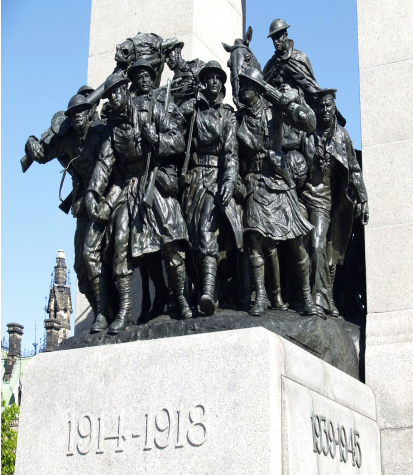

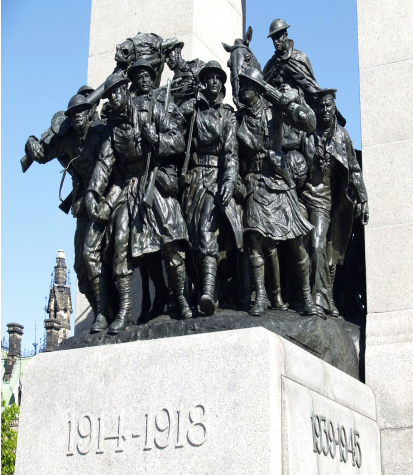

Memorial Day is a time to pause and reflect as a nation

At 3 p.m. local time, Americans are asked to take part in the National Moment of Remembrance, a time to pause in a moment of silence to honor those who have died serving the U.S.

Originally established during the Civil War, Memorial Day honors those who have died in military

service for the U.S. In recent history, Memorial Day has meant the unofficial start to summer. Families BBQ on the grill, the local pool announces its opening day, retailers promote big sales. While everyone has the freedom to celebrate as they choose, Americans should also remember that this holiday is really a somber occasion to pause and reflect as a nation.

Over 1.3 Million Americans have paid the ultimate sacrifice for their nation. Memorial Day was originally called “Decoration Day.” In 1869, the head of an organization of Union veterans, Maj. Gen. John A. Logan, established Decoration Day as a way for the nation to honor the graves of those who died in the Civil War with flowers, according to the U.S. Department of Veterans Affairs.

In 1971, Congress declared Memorial Day a national holiday, placing it as the last Monday in May. According to the VA, the day was expanded to hon-or all those who have died in American wars. Congress in December 2000 passed, and the president signed into law “The National Moment of Remembrance Act,” to ensure those who sacri-ficed their lives for the country were not forgotten.

Benefits of having a Medicare Consultant

Having a Medicare Consultant readily available can provide many benefits to healthcare providers. Medical groups and healthcare providers can benefit from their specialized knowledge and support, ultimately improving patient care, financial performance, and overall operational efficiency.

Expertise in Medicare regulations

Medicare regulations can be complex and constantly changing. A Medicare consultant stays up to date with the latest rules and guidelines, ensuring compliance minimizing the risk of penalties or audits.

Medicare education and training

Medicare consultants can provide education and training to healthcare providers and staff, ensuring they have a thorough understand-ing of Medicare rules, requirements, and best practices.

Identification of revenue opportunities

Medicare consultants can identify potential revenue opportunities, such as participating in value based care programs or implementing chronic care management services, to enhance financial performance.

Patient eligibility and enrollment assistance

Medicare consultant can assist patients in understanding their Medicare eligibility , enrollment options, and coverage benefits, Ensuring they receive the appropriate care and services.

Collaboration with payers and networks

Medicare consultants can facilitate collaboration and negotiations with Medicare Advantage plans, ac-countable care organizations (ACOs), and other payer

“Juneteenth National Independence Day,” or “Emancipation Day.”

Juneteenth is Wednesday, June 19, 2024! Juneteenth is the old-est-known celebration marking the end of slavery in the United States, first recognized by the state of Texas. It is also known as “Freedom Day,” “Juneteenth National Independence Day,” or “Emancipation Day.”

“Now I’ve been free, I know what a dreadful condition slavery is. I have seen hundreds of escaped slaves, but I never saw one who was willing to go back and be a slave.” –Harriet Tubman (1820–1913), American abolitionist and political activist.

“Every year, we must remind successive generations that this event triggered a series of events that one by one define the challenges and responsibilities of successive generations. That’s why we need this holiday.” –Texas Rep. Albert Ely Edwards (1937–2020), sponsor of Texas House Bill 1016 (1979), which made Emancipation Day (“Juneteenth”) a statewide paid holiday.

RMD´S

Required minimum distributions (RMDs) are a fact of later life for holders of most types of retirement savings accounts. (The notable exception is Roth IRAs, which are not subject to annual required withdrawals while the owner is alive. Starting with the 2024 tax year, this exception will also apply to Roth 401(k) and 403(b) accounts.)

Standard tax deduction

Most taxpayers take the standard deduction rather than itemizing on their tax returns. For the 2023 tax returns they must file by April 15, 2024, married couples in that majority can take $27,700 off their taxable income, up from $25,900 the year before. For individual taxpayers (single or married filing separately), the standard deduction increases from $12,950 to $13,850. Those filing as a head of household can deduct $20,800, up from $19,400 the previous year. networks, ensuring favorable contracts and partnerships.

Staying ahead of industry trends

Medicare consultants stay informed about industry trends, policy changes, and emerging reimbursement models, providing valuable insights and guidance to healthcare providers for strategic planning and decision making.

Full retirement age

Congress voted in 1983 to gradually raise the Social Security full retirement age (FRA) from 65 to 67. Four decades on, the change is nearly complete, with FRA reaching 66 and 8 months in the latter half of 2024.

Social Security earning test

If you claim Social Security retirement benefits before reaching full retirement age (FRA) and continue to do paying work, your benefits may be temporarily reduced. That depends on whether your annual working income exceeds a set limit called

the earnings test.

For more detailed information please visit: AARP and Medicare & You | Medicare